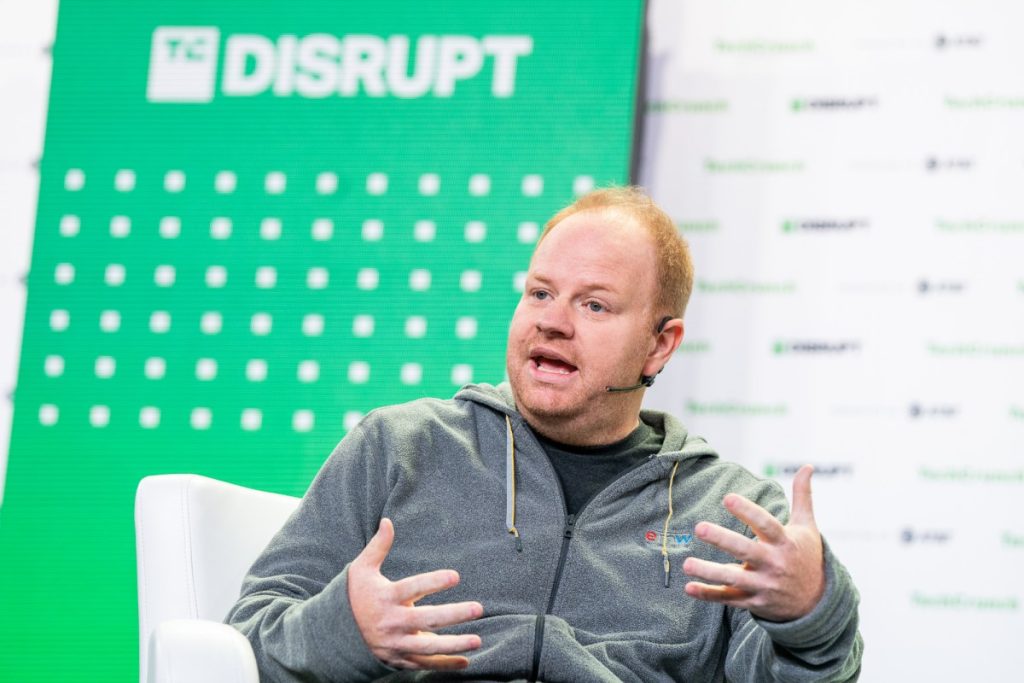

What is the right way to build a software business? Many startup advisers say that B2B software should solve one pain point, gain customers, then add features as their company grows. Serial founder Parker Conrad, currently the founder and CEO of Rippling, an HR software startup valued at $13.5 billion in April, thinks that’s the wrong way to do it.

Conrad said on a recent episode of TechCrunch’s Found podcast that he thinks the advice given to software founders over the last two decades has been misguided.

“I think the conventional wisdom for how to build business software has been that you should focus very narrowly, and you should build this one very narrow thing and go very deep,” he said. “I think that as a result of that conventional wisdom, we’ve been building business software wrong for the last 20 years. The side effect of building these very narrow applications is that businesses now have to manage 100 different separate pieces of software to run their business, and there’s a lot of inefficiency in that.”

Conrad is naturally talking his book here. Rippling aims to be an all-encompassing solution for everything from payroll to expense management and corporate cards to IT solutions. When Conrad was asked about how he felt about competition, he responded that it depends what a potential customer is looking for. For finance, Conrad said Rippling competes with Brex and Navan while for payroll solutions it might compete with Gusto.

“The secret to building better business software is building a system where you can build multiple parallel business software applications that are all natively built into the same system,” Conrad said.

He said that building software in this way allows companies to take one data set and build multiple applications on top of it which can result in a standardized user experience. It also gives companies more options to price their offerings, he added.

While there are definitely areas where it is good to have a company focus and go deep, like cybersecurity, Conrad’s notion that platforms perform better than function-specific companies has merit to it — especially in times of economic depression where enterprises don’t have as much money to spend on software.

TechCrunch reported last year that many SaaS startups were likely going to struggle or have to consolidate after the market froth of 2020 and 2021 resulted in many one-feature startups getting launched and funded.

At the time, Loren Straub, a general partner at Bowery Capital, said similar. Straub told TechCrunch in January 2023 that no one wants to back a startup producing a product that isn’t much more than one feature because such startups have no moat, or element that sets them apart from potential competitors. She said companies don’t like to spend on single-feature tech in general, let alone when budgets have tightened.

VC Mark Goldberg, a partner at Index Ventures at the time, who has since launched his own fund, echoed that sentiment when he spoke to TechCrunch last year. He said large companies are more likely to use less-than-stellar offerings from their existing contracts before they sign a new one with a one-note startup.

“Before Slack sold to Salesforce, one of the scary things was Microsoft launched Teams,” Goldberg said at the time. “We all in Silicon Valley thought it was a fine product and thought it was better than Slack but a lot of people don’t care. Why do we need a separate vendor? That’s an area where best in class may not have helped.”

Conrad hopes the horizontal approach he’s taken with Rippling both attracts customers and keeps them as the market ebbs and flows. It’s worked so far.

“Now every single software vertical has like a dozen competitors, and it’s extremely crowded,” Conrad said, adding that customers prefer an approach where a software company will “build the system that sort of recombines all of this and gives people one system that combines a lot of these capabilities and wins.’”