That $1.3 trillion just sort of came and went within a month, and people didn’t really notice – amazing.

By Wolf Richter for WOLF STREET.

The week was marked by the continued tech sell-off and the wilting of the hugely promoted “rotation” into small-caps: The S&P 500 dipped 2.0%, the Nasdaq composite fell 3.6%, the Nasdaq 100 fell 4.0%, and the Magnificent 7 fell 4.7%.

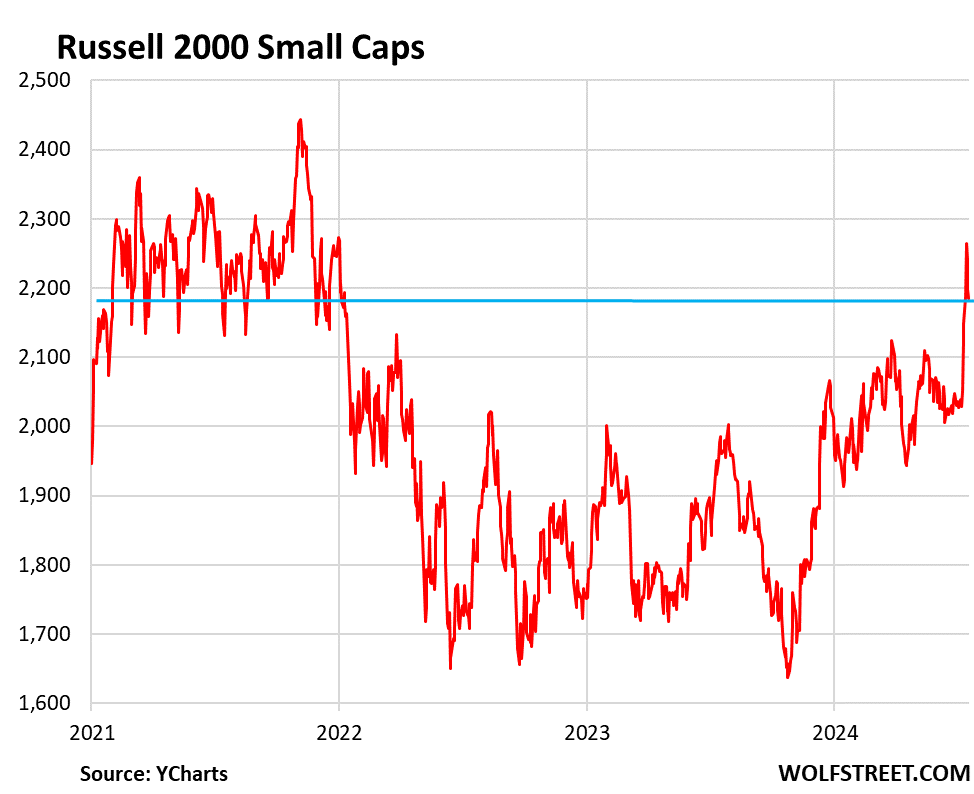

But the Russell 2000, which tracks nearly 2,000 small stocks, spiked 5.3% during the first two days of the week, as part of the “rotation” into small stocks, and then got hammered down 3.5% over the remaining three days of the week, and ended the week up 1.7%, to be right back where it had been in February 2021.

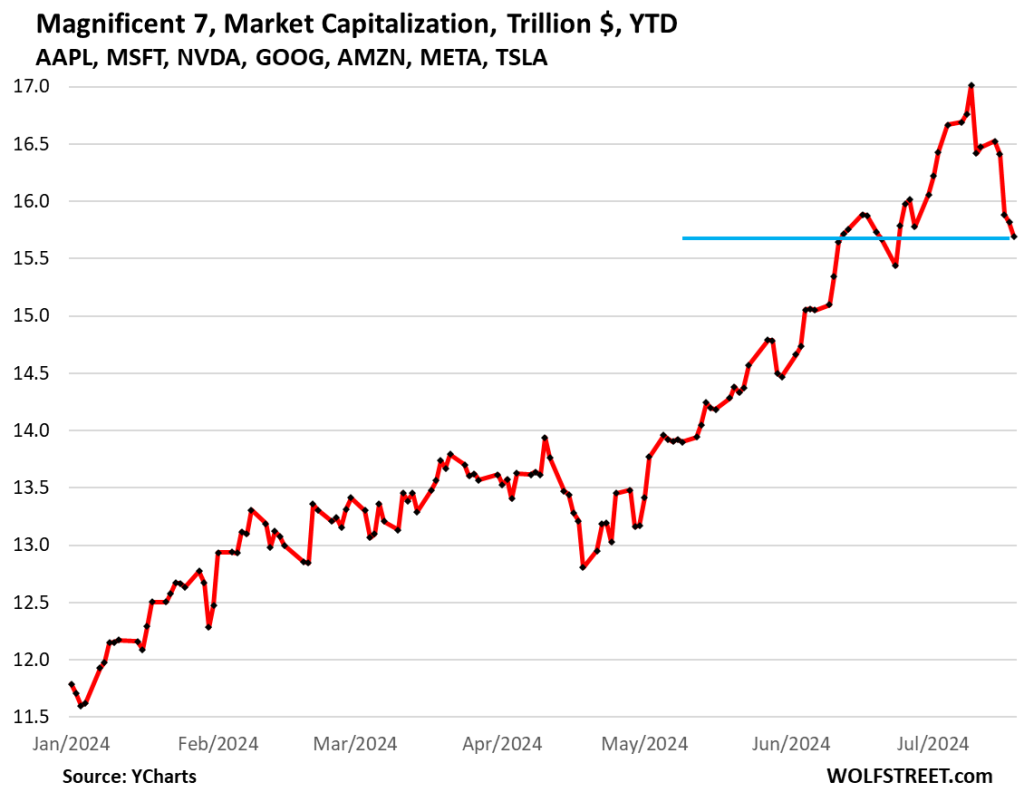

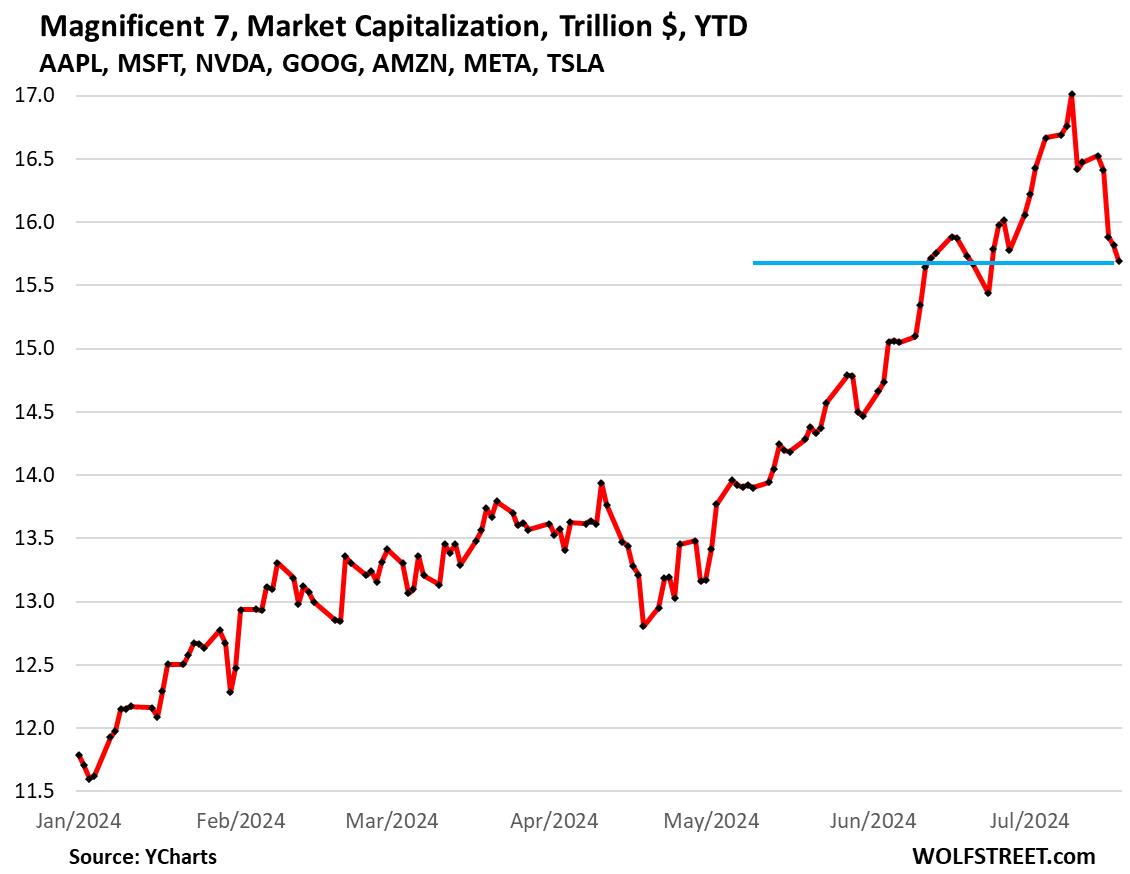

The Mag 7 lost another $113 billion in market cap on Friday, bringing the total decline from the peak on July 10 to $1.32 Trillion (-7.7%). That $1.32 trillion just sort of came and went in about a month, spread over just seven stocks, and people didn’t really notice – amazing when you think about it. It used to be some serious money.

Their combined market capitalization is now down to $15.69 trillion, from over $17 trillion on July 10. The Mag 7 are now back where they had first been on June 13. This $1.32 trillion has blown past the dollar-decline in April (-$1.13 trillion). But the 7.7% drop still doesn’t quite measure up to the April drop of 8.1%.

The declines of the individual stocks in the Mag 7, from the July 10 peak (Nvidia bounced on Thursday but gave it up again on Friday):

- Apple [AAPL]: -3.6% (-$129 billion)

- Microsoft [MSFT]: -6.3% (-$217 billion)

- Alphabet [GOOG]: -6.9% (-$164 billion)

- Amazon [AMZN]: -8.3% (-$173 billion)

- Tesla [TSLA]: -9.2% (-$78 billion)

- Meta [META]: -10.8% (-$146 billion)

- Nvidia [NVDA]: -12.3% (-$410 billion).

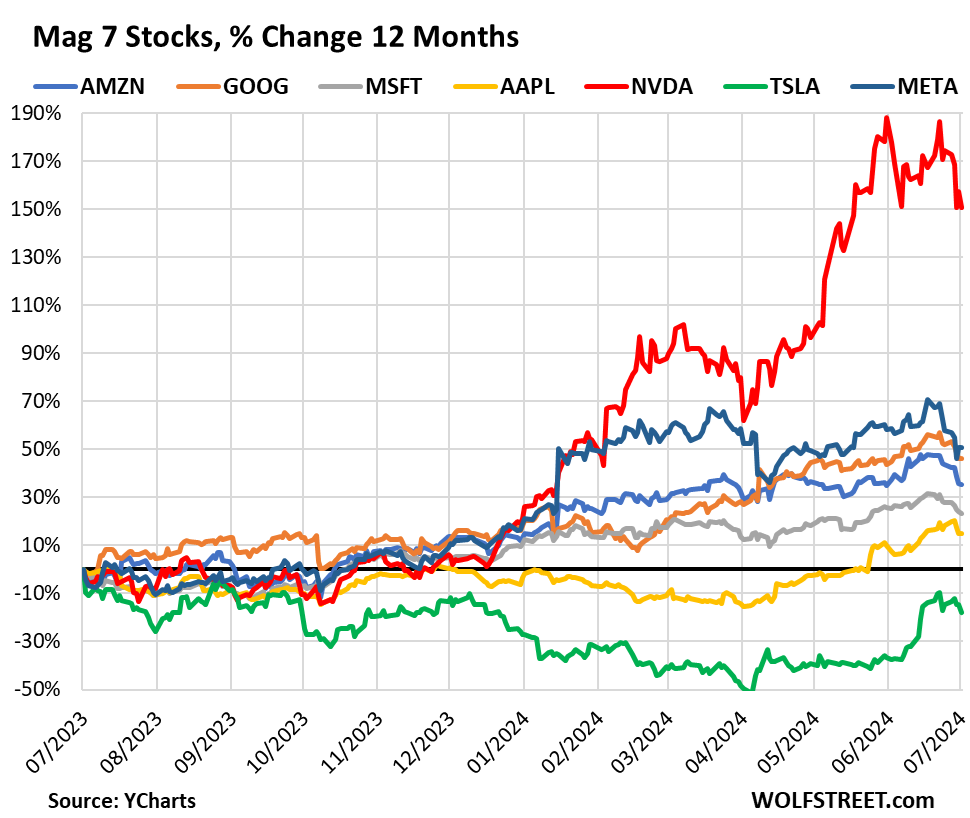

Over the past 12 months, in percentage terms, two of the Mag 7 stick out:

- Nvidia, which is still up 150% in 12 months, despite the recent decline (red line in the chart below)

- Tesla, which is still down 18% in 12 months, and down 42% from the all-time high in February 2021 (green).

The 12-month gains of the remaining 5 Mags are dwarfed by Nvidia’s 150% gain, though they’re still steep despite the recent declines:

- Meta: +50.9%

- Alphabet: +46.1%

- Amazon: +35.3%

- Microsoft: +23.1%

- Apple: +15.0%.

Small stocks keeled over on Wednesday, July 17, after their sudden bout of glory during which the entire market was supposed to “rotate” into them, or whatever.

The Russell 2000 had spiked by 11.5% during the five trading days between July 9 and July 16. On Wednesday, the index began to drop, and on Friday, it closed down 3.5% from the Tuesday high. But thanks to the 5.3% spike during the first two days of the week, the index was still up 1.7% for the week.

The Russell 2000, at 2,184, is right back where it had been in February 2021. That kind of sudden spike and drop is not soothing our anxieties, for sure.

The Nasdaq 100 Index, which tracks the 100 largest nonfinancial stocks on the Nasdaq and is dominated by big tech and social media stocks, fell by 4.0% for the week and is down by 5.6% from the peak on July 10.

Year-to-date, the index is up 16%, despite the two sell-offs. The first one in April ended with a 6.2% drawdown.

Since the beginning of 2021, the index is still up 51.5%, with a huge trough in the middle. It has shot up 88% from the bottom of the trough in December 2022. That dizzying move to these dizzying highs is not soothing our anxieties at all:

The S&P 500 has just started to show the first impact of the tech drama. The sell-off has been puny so far. The index fell 2% for the week and is down 2.9% from the high on Tuesday.

Since the beginning of 2021, the index has soared by 47%. Since the bottom of the trough in October 2022, the index has soared by 53%. These are huge fast gains on top of already very high valuations, and the draw-down so far has been nearly nothing:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()